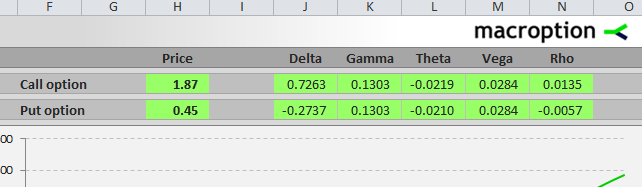

GitHub - TFSM00/Black-Scholes-Calculator: Calculation and Visualization of Option Price and Greeks on European Options using the Black-Scholes Option Pricing Model

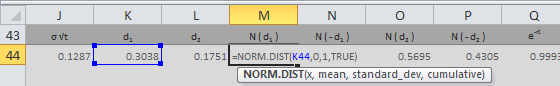

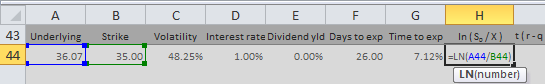

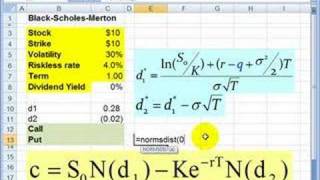

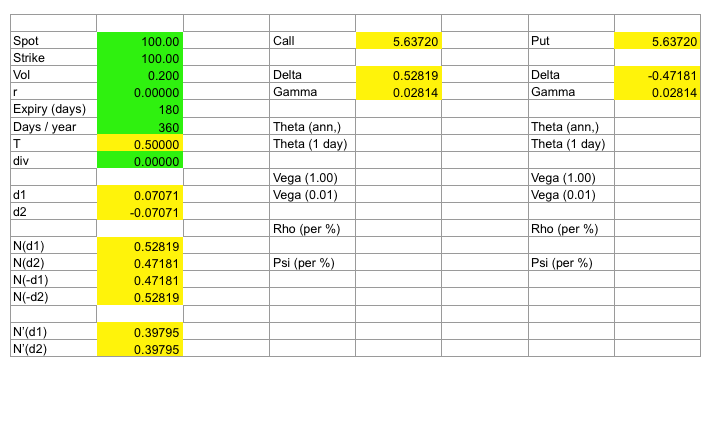

An alternative calculation of the Black Scholes formula for effective hedging programmes - The Global Treasurer