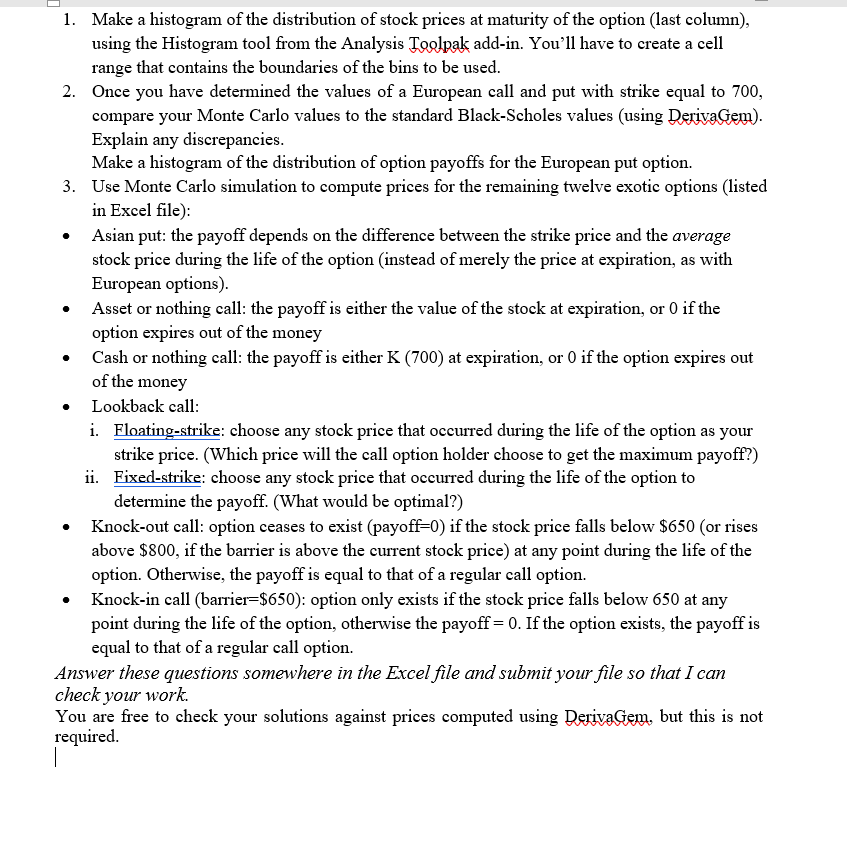

Option pricing - Exotic Options - Pricing Asian, Look backs, Barriers, Chooser Options using simulators - FinanceTrainingCourse.com

Option Pricing using Monte Carlo Simulation - Pricing Exotic & Vanilla Options in Excel - Introduction - FinanceTrainingCourse.com

Asian Option Pricing in Excel using QuantLib: Monte Carlo, Finite Differences, Analytic models for Arithmetic and Geometric Average. Example with live EUR/USD rate - Resources

Option pricing - Exotic Options - Pricing Asian, Look backs, Barriers, Chooser Options using simulators - FinanceTrainingCourse.com

Using the NAG Library to calculate financial option prices in Excel Marcin Krzysztofik and Jeremy Walton 1 Introduction 2 Option

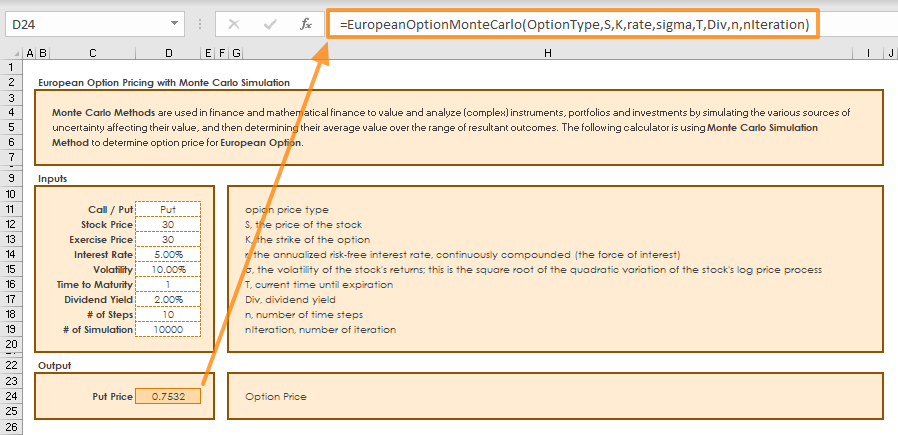

How can I implement Monte-Carlo Simulations in MS Excel? – Computer Aided Finance - Excel, Matlab, Theta Suite etc.

Monte Carlo Pricing of any European Structured Product in Excel: Revisiting the Morgan Stanley Trigger Plus 2024 Note - Resources

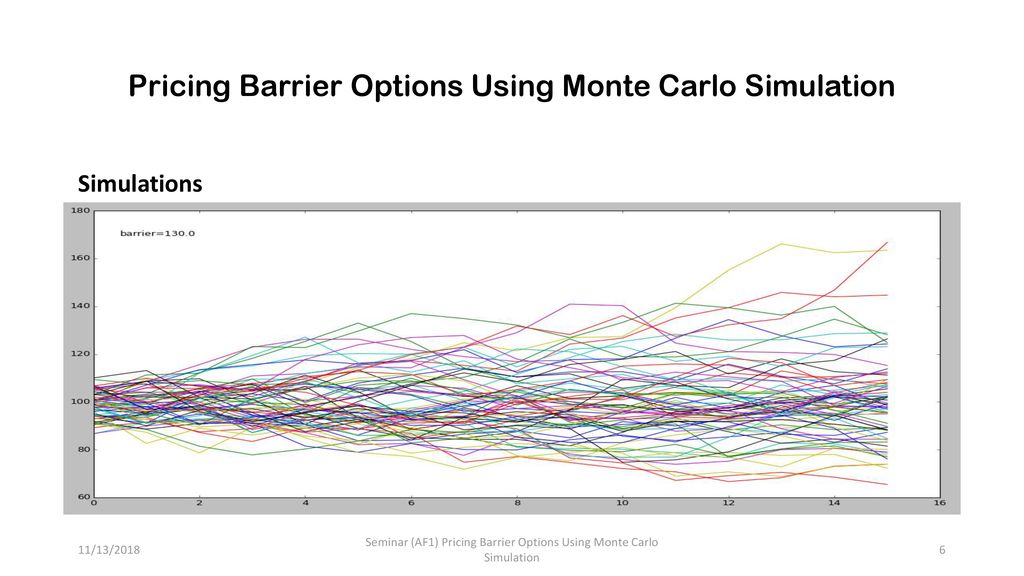

Option pricing - Exotic Options - Pricing Asian, Look backs, Barriers, Chooser Options using simulators - FinanceTrainingCourse.com

![Plan for Growth with the Monte-Carlo Simulation [No Code Solution] | Ladder.io Blog Plan for Growth with the Monte-Carlo Simulation [No Code Solution] | Ladder.io Blog](https://uploads-ssl.webflow.com/6098e41066be8b2b7cb437cd/60f02f320d401a0c0d63abfe_20200228_LAD_Blog_Image_Plan-for-Growth-with-Monte-Carlo-Simulations-01.png)