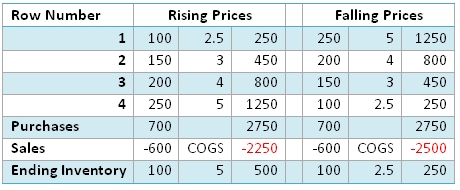

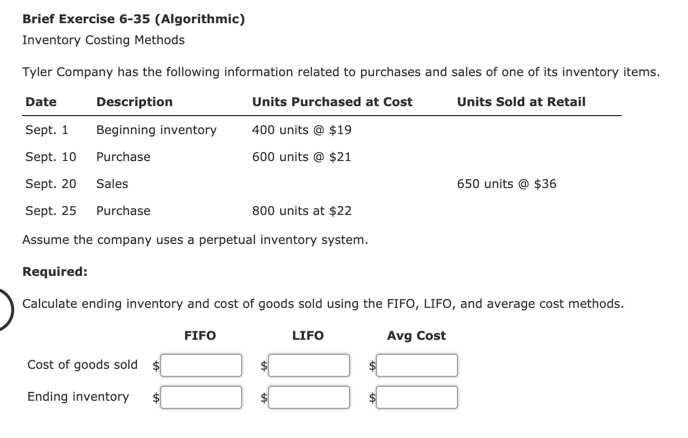

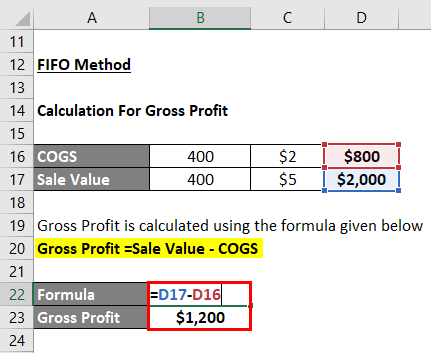

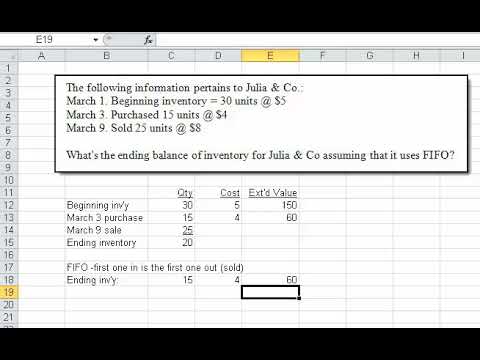

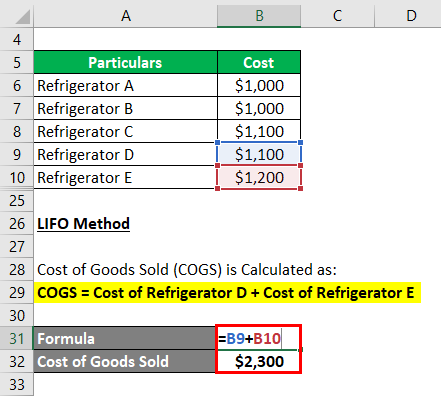

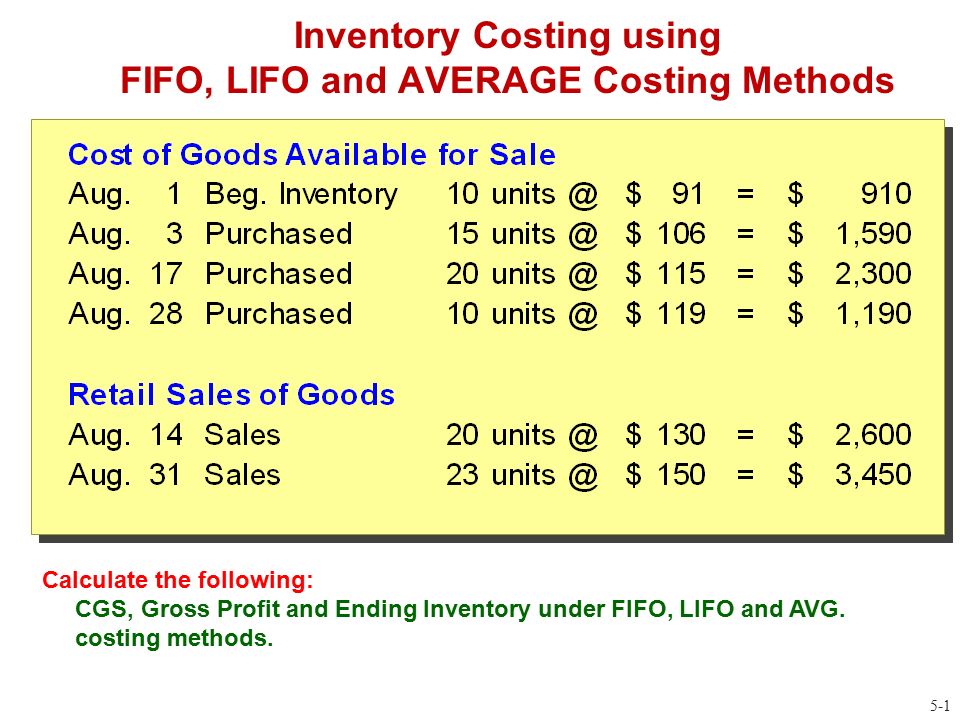

Inventory Costing using FIFO, LIFO and AVERAGE Costing Methods 5-1 Calculate the following: CGS, Gross Profit and Ending Inventory under FIFO, LIFO and. - ppt download

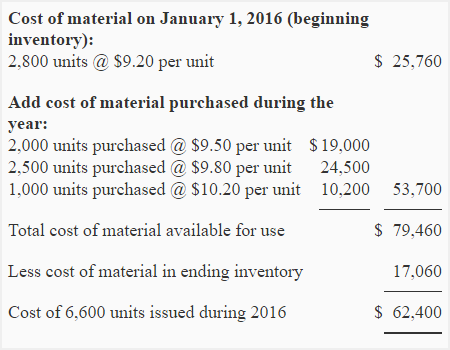

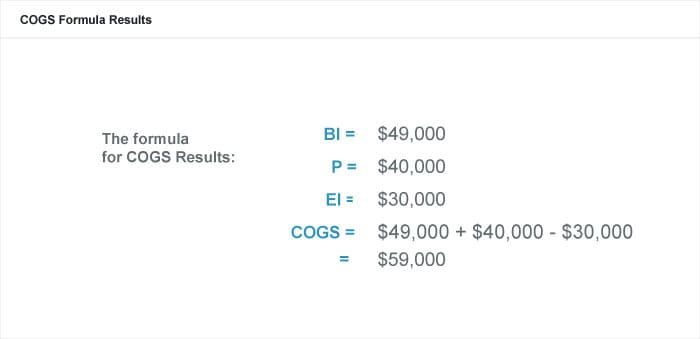

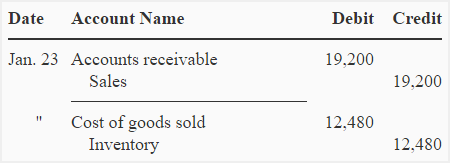

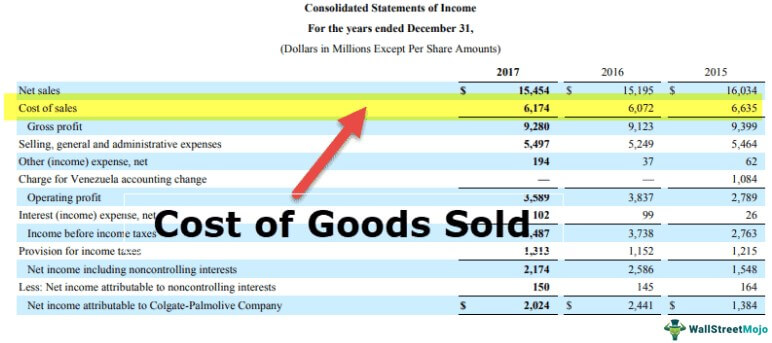

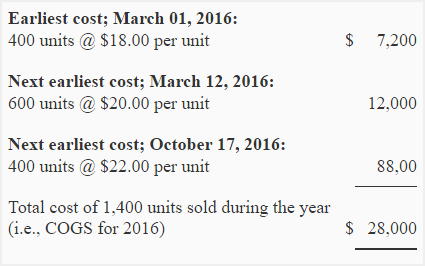

Calculate the Cost of Goods Sold and Ending Inventory Using the Periodic Method – SPSCC — ACCT&202 working

10.2: Calculate the Cost of Goods Sold and Ending Inventory Using the Periodic Method - Business LibreTexts